The Hedera (HBAR) network is reportedly facing a potential attack, with several DApps on the platform suspending their operations. This development has resulted in a significant drop in HBAR’s price, as the crypto community continues to speculate about the nature of the issue.

HBAR Foundation: Many major DApps running on the Hedera network have reported suspicious activities in recent times, leading to a halt in their operations. This has sparked speculation that the network may be under attack, as opposed to a mere technical glitch.

We’ve noticed network irregularities that are impacting various Hedera dApps and their users.

The Foundation is in communication with impacted partners. We’re monitoring and working to help resolve the issue.

Please standby for more information.

— HBAR Foundation (@HBAR_foundation) March 9, 2023

HBAR Under Attack? The Hashport Network, which is a cross-chain solution built on Hedera, was the first to detect the irregularities in the network. They subsequently terminated their Hashport bridge, which had been used for transferring digital assets across various networks. Other users of Hedera-based applications have since reported abnormal behavior and have been advised to refrain from utilizing the network altogether to protect their funds. The HBAR Foundation, which is Hedera’s development arm, has acknowledged the issue and stated that they are currently monitoring and resolving it.

According to sources, the network’s top two services, the Hedera Token Service (HTS) and Hedera Consensus Service (HCS), have been adversely affected. This means that most of the tokens built on the Hedera network are at risk of being exploited. The attackers are believed to be targeting the decompiling process in the network’s smart contracts. Major DEXs, such as Pangolin, have advised their users to withdraw all HTS-based tokens from the platform.

Due to some Hedera network irregularities, Hashport has paused their bridge, and we’d encourage anyone with HTS tokens in Pangolin Pools and Farms to withdraw immediately.

This is a time critical moment, so we’ll update as soon as we have more information

— Pangolin Hedera (@Pangolin_Hedera) March 9, 2023

Impact On HBAR Price The total value locked (TVL) in Hedera has reportedly dropped by approximately 17%, according to Defillama’s crypto tracker. While there has been no official confirmation of a hack or an organized exploit, many in the crypto community suspect that the same group that recently attacked Algorand may be behind the incident. It is worth noting that Algorand’s MyAlgo wallet was recently subject to a similar attack, which resulted in the loss of $9.6 million.

Although HBAR itself is not directly exposed to the exploit, the tokens built using HTS are, and this has raised questions about the network’s security and reliability. This negative sentiment has prompted a significant exodus of users, who are unstaking their HBARs to sell them on the open crypto market. However, Stader Labs, the largest staking platform for Hedera, has paused the unstaking process temporarily, meaning that users will not be able to withdraw their staked HBAR for some time.

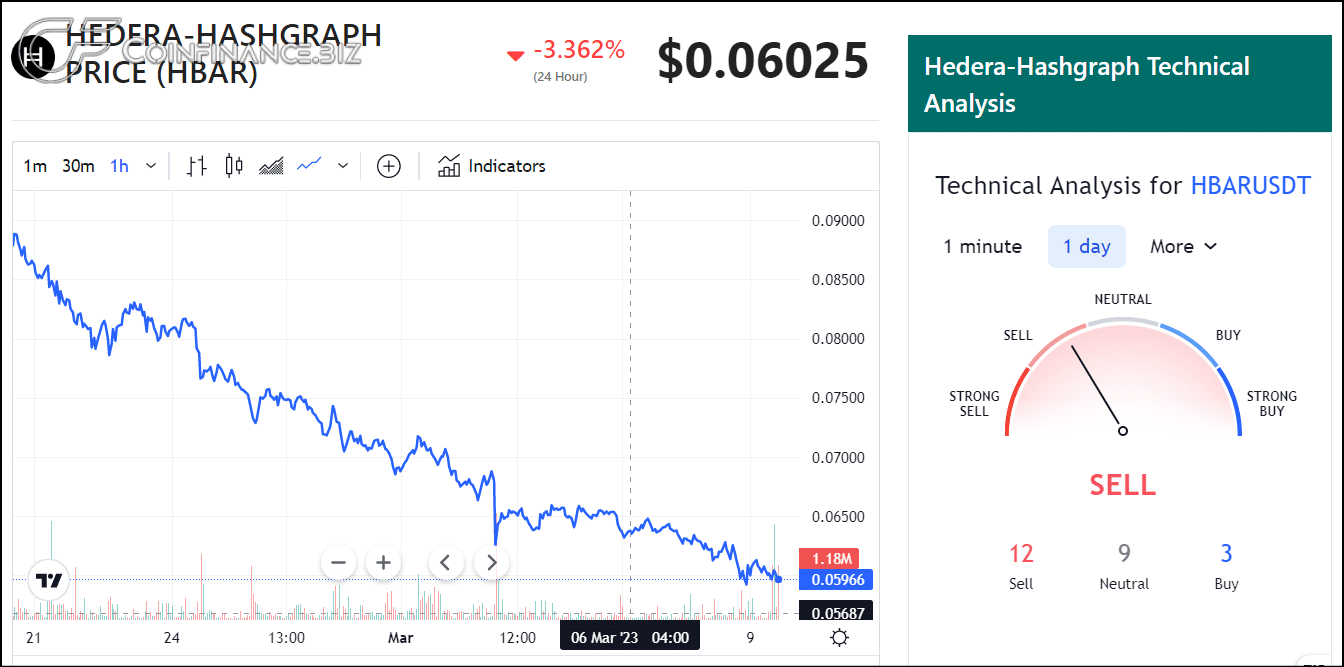

Furthermore, HBAR’s technical analysis (TA) indicators suggest a sell position for the altcoin, advising a “sell” at level 12 and a “buy” at level 3. As a result of the recent developments, the price of Hedera is presently trading at $0.060, a decrease of 2.5% over the past 24 hours, compared to a drop of 10.71% recorded over the preceding seven days.

In conclusion, the Hedera network’s security and reliability have been called into question following the recent incident. Although there has been no official confirmation of a hack or an organized exploit, the negative sentiment surrounding the network has led to a drop in HBAR’s price, with many users choosing to sell their tokens. The incident serves as a stark reminder of the need for robust security measures in the crypto space.