Investors’ sentiment has shifted last week as concerns of a financial crisis have started to ease up. US Energy and Materials stocks have followed the oil price upward trend while Financials continued to recover. Meanwhile, the Healthcare, Tech and Telecom sectors, which had outperformed over the past two weeks, lagged behind. With the start of the second quarter, it’s time to assess the current market situation.

Market Valuations and Growth Forecasts

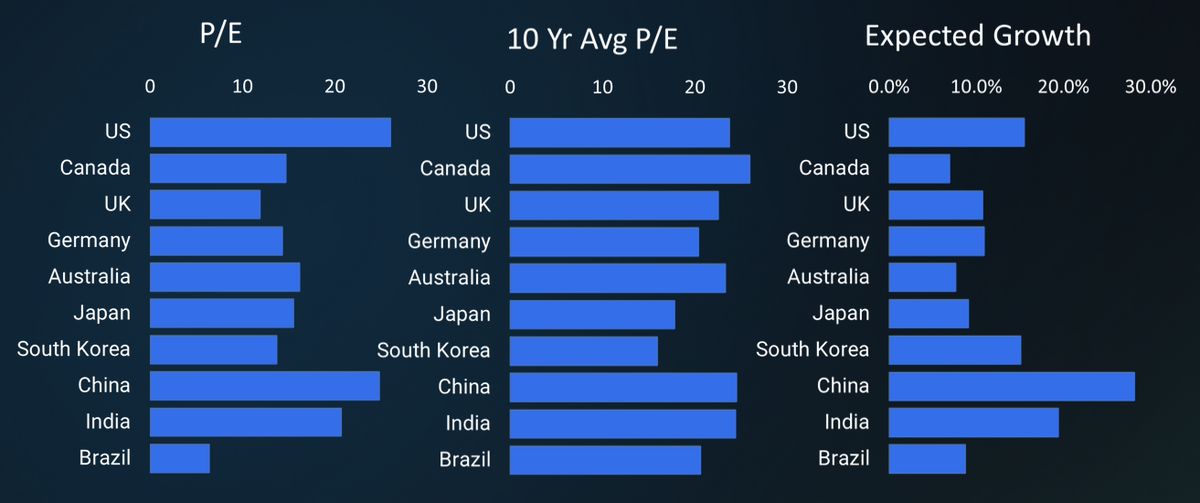

It is worth taking stock of equity valuations following recent events. The P/E ratios of 10 major markets, along with their 10–year average P/E ratios, and their expected EPS growth rates over the next few years are shown below.

Most markets are still trading below their 10-year average P/E ratios, except for the US and China, which have higher earnings growth forecasts, making investors pay more for growth.

While the averages for each market are lower, valuations and forecasts vary widely within each market. It is possible to drill down to the sector and industry level for each country on the Simply Wall St Markets page.

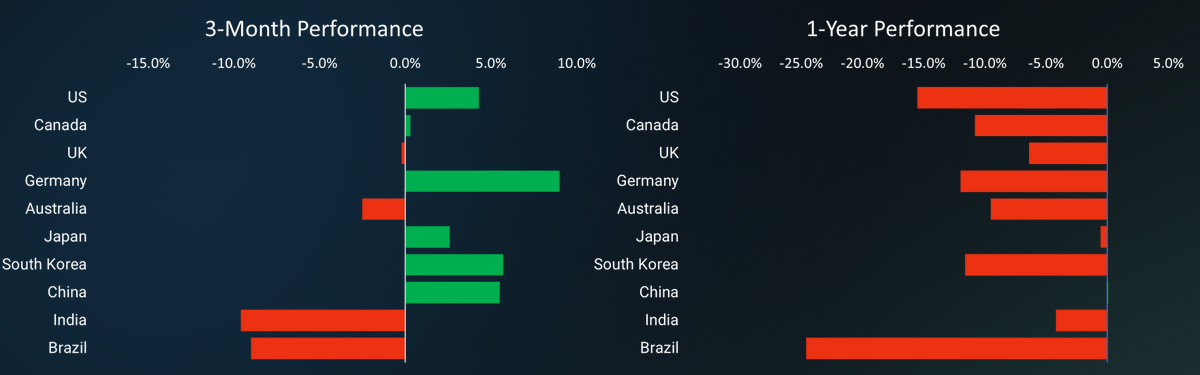

Performance over the last 3 months and 12 months shows that countries with significant exposure to tech and telecom companies were among the worst performers over 12 months, and then regained the most ground over the last 3 months. On the other hand, weak commodity prices have affected commodity producers like Canada, Australia, and Brazil. Technology, telecom, consumer discretionary, utilities, and industrials have been the top performing sectors across most countries over the last few months.

Forecasts Change As The Facts Change

As earnings forecasts continue to fall each quarter, the forecasts mentioned earlier are for the long-term, but they will also have to come down if the earnings recession persists. High valuations and falling forecasts put equity prices at risk. Expect valuations and growth forecasts to change as new information about earnings and the macroeconomic environment arises.

Is The Market In ‘Risk On’ or ‘Risk Off’ Mode?

The sectors associated with growth, such as tech and consumer discretionary, are leading the upside, suggesting that investors are either anticipating rate cuts or a favorable economic outlook. Conversely, some defensive and safe haven assets such as gold, bonds, and utility stocks are performing well.

The top-performing sectors are large, well-capitalized companies with strong cash flows, which have dragged the sectors higher, making companies like Microsoft and Apple the new defensive stocks. Financial and real estate sectors have lagged due to two banking crises and rising rates, while energy and materials stocks have been dragged down by falling commodity prices.

However, other ‘risk on’ assets have also underperformed since January, namely small caps, emerging market stocks, and high-yield bonds.

Insight: Risk Appetite Has Disappeared Faster Than It May Seem

Earlier this year, global markets saw the return of risk appetite as investors rotated into underperforming sectors. Since then, headline indexes have fallen only slightly, but there has been a lot of rotation into more defensive assets.

What This Means For Investors

Growth sectors are doing relatively well, and there is a risk that lower quality or riskier stocks (and other assets) will get caught up in the momentum. If you are considering investing in these stocks, ensure they are well-capitalized and expected to be cash flow positive soon. As for Bitcoin, whether it is now a safe haven asset or a speculative risk asset remains an open question.

The Market Is Betting Against The Fed… Again!

Despite the Fed’s statements that it intends to remain patient in terms of future rate hikes, market participants are betting against it. The current futures market indicates a higher probability of a rate cut than an increase in the near future.