Crypto.com, a leading crypto-exchange, is currently facing issues with maintaining its On-Ramp Fiat due to the ongoing banking crises. Reports suggest that the exchange may soon lose its ability to accept USD deposits, which could raise concerns about its liquidity.

Crypto.com’s Difficulties with On-Ramp Fiat

On-Ramp Fiat refers to the ability of a crypto-exchange to accept fiat currency deposits. Crypto.com is facing difficulties in this area due to its banking partners’ stance on cryptocurrencies. The banking sector is becoming increasingly cautious about providing banking services to crypto-related businesses due to regulatory concerns and risks associated with money laundering.

As a result, Crypto.com may soon lose its ability to accept USD deposits, which could negatively impact the exchange’s liquidity. Furthermore, a crypto-exchange that fails to offer most cryptocurrency exchange pairs denominated in USD could be rated as less liquid.

Crypto.com’s Banking Partners

Crypto.com’s problems with On-Ramp Fiat are primarily due to its banking partners’ stance on cryptocurrencies. The exchange has had to switch banking partners in the past due to account blockages and other issues.

For instance, the exchange had to find a new banking partner to provide euro-denominated banking services to users in the European Economic Area (EEA) after its previous provider’s accounts were blocked by the Central Bank of Lithuania. However, the new provider has recently reduced access to EEA residents through the Single Euro Area (SEPA) system, which has limited EUR deposits/withdrawals through the service provider to EEA residents only.

In the US, Crypto.com had to distance itself from Silvergate Bank, one of its banking partners, after the bank failed to file its 10-K report with the US Securities and Exchange Commission (SEC). Metropolitan Commercial Bank, another banking partner, also exited the cryptocurrency industry in January following a review by its board of directors.

Cronos (CRO) Price Dump

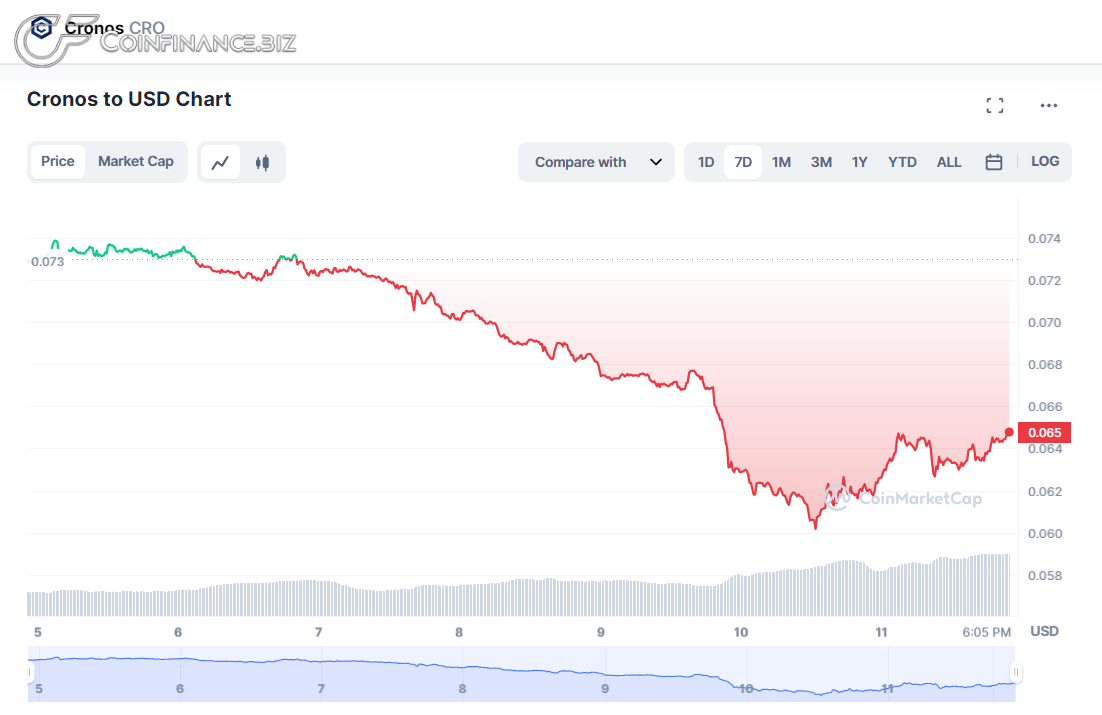

Cronos (CRO) is Crypto.com’s exchange token, and like most cryptocurrencies, it has experienced a price dump in the past seven days. At the time of writing, CRO is worth $0.064, which is a ∼15% drop from last week’s $0.073.

Despite the banking issues, Crypto.com’s CRO has a trading balance of $3.6 billion and a stablecoin balance of $776 million. It also recorded a positive net flow of $248.8 million in the last week. The 33rd crypto by market capitalization, it still holds a total market cap of $1.5 billion, with a dominance of 0.17% in the crypto market.

Conclusion

Crypto.com’s difficulties with On-Ramp Fiat due to its banking partners’ stance on cryptocurrencies highlight the challenges faced by crypto-related businesses. The exchange’s ability to accept fiat deposits is essential to its liquidity, and any disruption in this area can impact its operations negatively.

Despite these challenges, Crypto.com continues to offer its users the ability to purchase cryptocurrencies via credit card and has waived fees for new users for the first week. Additionally, the exchange’s CRO token continues to be one of the top cryptocurrencies by trading volume and market capitalization.

As the crypto industry evolves, it will be interesting to see how exchanges like Crypto.com navigate regulatory challenges and maintain their liquidity while serving their users.