The recent increase in the Federal Reserve’s target interest rate by 25 basis points has caused market turmoil, impacting the cryptocurrency market. The week in markets witnessed a significant fluctuation in the value of digital assets, with crypto prices rising ahead of the Fed’s decision and then dropping afterward.

Bitcoin, the leading cryptocurrency by market capitalization, was trading at around $27,600 by 10 a.m. ET, up 0.4% over the past seven days, according to TradingView data. However, the cryptocurrency market remains volatile as investors assess the impact of the interest rate hike.

Macro Matters: Fed’s Decision and Market Volatility

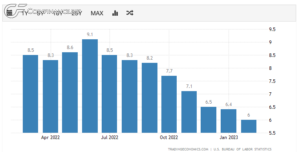

The Federal Open Market Committee (FOMC) announced its decision to increase the Fed Funds target rate by 25 basis points, increasing the target range to between 4.75% to 5% from 4.5 to 4.75% on Wednesday. The FOMC considered a pause in the days leading up to the decision, but it ultimately chose to increase the rate.

While the Fed has made it clear that there is still a long way to go until inflation falls to the Fed’s

goal, the recent interest rate hike has caused market volatility. According to a recent report by the Centre for Economic Policy Research, market volatility during Chair Powell’s news conferences is three times higher than those held by his predecessors. Additionally, his time in front of reporters tends to reverse the market’s initial reaction.

Impact on Digital Assets

The Fed’s interest rate hikes have been a headwind for digital assets, such as bitcoin, as non-yield bearing assets look less attractive, especially as inflation declines and real yields rise. As Chris Kuiper, Director of Research at Fidelity Digital Assets, told The Block, the drop in bitcoin following the announcement “may have been a similar reaction given the Fed’s posturing that higher rates may still be warranted.”

However, the narrative may be shifting, as investors appear to be pricing in rate cuts “sooner rather than later,” as evidenced by a decline in the two-year treasury yield, which typically leads or coincides with the Fed’s target rate. Kuiper believes that a shift to easier money and more liquidity will likely be a positive for digital assets, particularly bitcoin, in the longer term.

Conclusion

The recent interest rate hike by the Fed has caused significant market volatility, impacting the cryptocurrency market. While non-yield bearing assets like bitcoin have looked less attractive, investors seem to be pricing in rate cuts in the near future, which may bode well for digital assets in the longer term. As always, market conditions can be unpredictable, and investors should exercise caution when investing in cryptocurrencies.