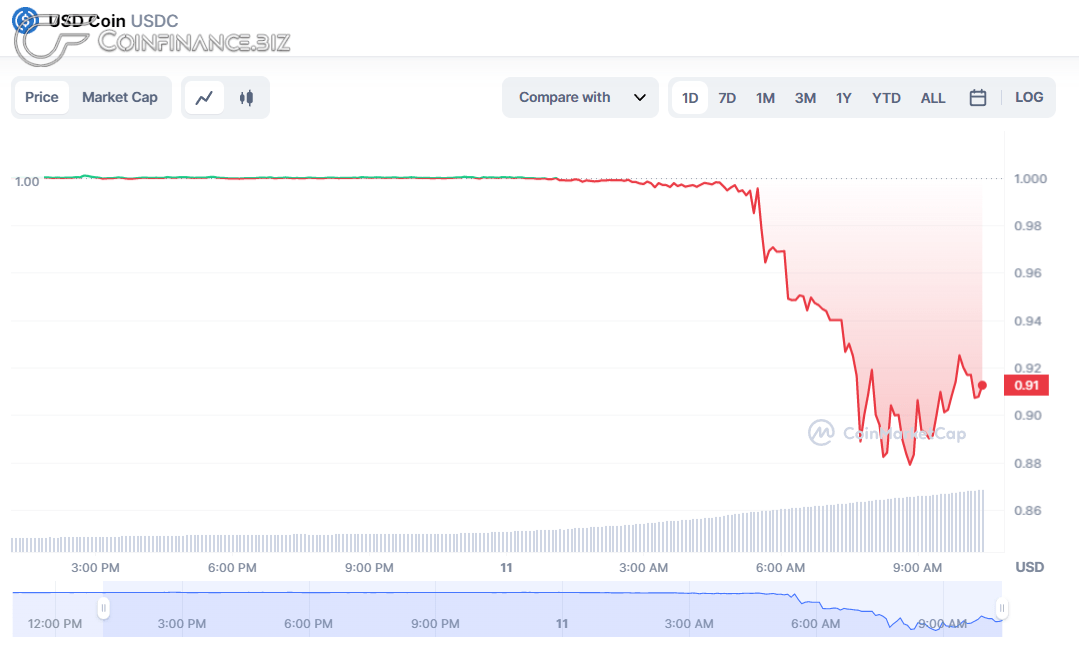

USDC Falls Below $1 Peg as Circle is Unable to Withdraw $3.3 Billion Reserves from SVB

USDC, a stablecoin pegged to the US dollar, has seen a decline in its value by more than 10% as of this writing, trading at $ 0.9126 . This drop in value came after Circle, the issuer of USDC, announced that it was unable to withdraw $ 3.3 billion of its $ 40 billion reserves from Silicon Valley Bank (SVB). The bank, which is insured by the Federal Deposit Insurance Corporation, was on the verge of closing operations.

Circle had initiated a wire transfer on March 9 to move its funds from SVB, but as of March 11, the transfer was not wholly processed, leaving $3.3 billion of USDC reserves with SVB. This news caused a sell-off resulting in USDC’s price falling below its $1 peg.

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle) March 11, 2023

USDC’s depeg from the US dollar has broader implications for businesses, banking, and entrepreneurs without a Federal rescue plan, according to Dante Disparte, Circle’s Chief Strategy Officer and Head of Global Policy. Disparte emphasized SVB’s critical role in the US economy and warned that the bank’s failure without a Federal rescue plan would have severe consequences.

Circle’s teams had worked at high speed to limit exposure to banks like Silvergate, including requesting a wire transfer before SVB’s FDIC receivership. However, the $3.3 billion cash exposure still remains, and the company follows state and federal regulatory guidance.

On-chain data reveals that Circle has already redeemed $1.4 billion USDC ” stablecoin ” in just eight hours, and other crypto companies like Coinbase and Jump Trading have redeemed approximately $850 million and $138 million USDC, respectively, to reduce their exposure.

Circle had recently announced plans to increase its staff headcount by 25%, despite the ongoing layoff trend, just two weeks ago on Feb. 23. Circle’s CFO, Jeremy Fox-Geen, shared the company’s intent to go public pending an improvement in market conditions, adding that the crypto industry needs more distance from Terra and FTX implosions for public investors to re-evaluate the future of digital assets businesses.