In a thought-provoking turn of events, Federal Reserve Governor Christopher Waller expressed on Friday that the headline inflation had been dramatically reduced by half since reaching its peak last year. However, it is disconcerting to note that prices, excluding food and energy, have shown minimal movement over the past eight or nine months.

Waller, during a question-and-answer session following a speech in Oslo, Norway, emphasized, “That’s the disturbing thing to me.” He further stated, “We’re seeing policy rates having some effects on parts of the economy. The labor market is still strong, but core inflation is just not moving, and that’s going to require probably some more tightening to try to get that going down.”

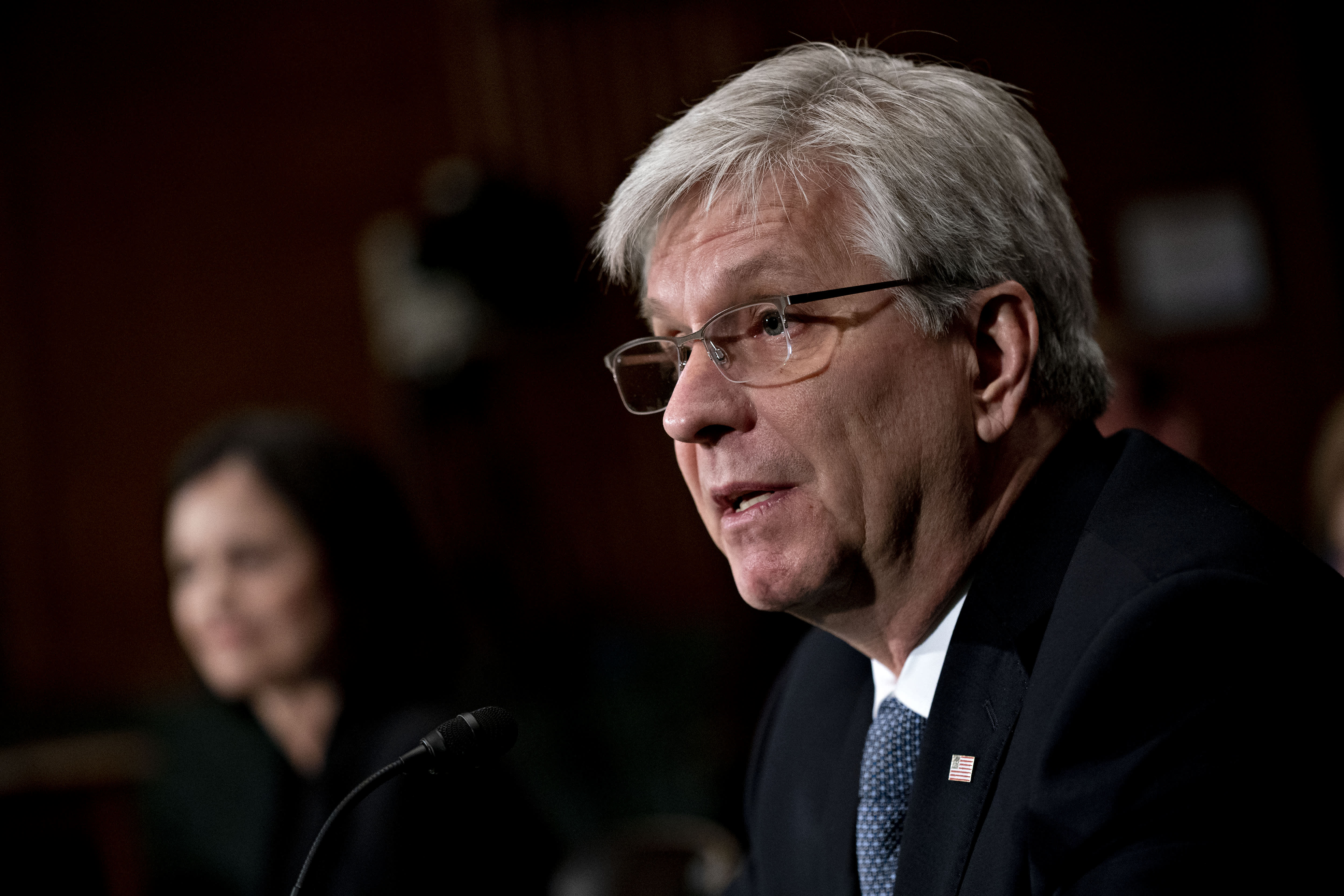

Meanwhile, Richmond Federal Reserve President Thomas Barkin, speaking at a separate event, asserted that inflation remained persistently high and displayed a stubborn nature. Barkin reinforced the target of 2% inflation and expressed his need for a convincing narrative demonstrating how slowing demand could swiftly restore inflation to the desired level. In his speech in Ocean City, Maryland, he stated, “If coming data doesn’t support that story, I’m comfortable doing more.”

Fed’s Barkin Comfortable Doing More to Slow Resilient US Economy

The Federal Open Market Committee (FOMC) recently paused its series of interest-rate hikes; however, policymakers anticipate rates moving higher than previously anticipated due to the unexpectedly enduring price pressures and labor-market strength.

Chicago Federal Reserve President Austan Goolsbee, in an interview with NPR, likened the pause to a reconnaissance mission, offering officials an opportunity to assess the impact of their policies on the economy. He elucidated, “I think of it as a reconnaissance mission, pausing now, to go scope it out before charging up the hill another time.”

While the latest consumer price index indicated a slowdown in headline inflation, core prices, excluding food and energy, continued to rise at a pace that concerns Fed officials. Recent data revealed a rapid increase in job additions during May, along with a rise in job openings in April.

Barkin cautioned against prematurely easing policies, emphasizing the potential costly repercussions. He stated, “I recognize that creates the risk of a more significant slowdown, but the experience of the ’70s provides a clear lesson: If you back off inflation too soon, inflation comes back stronger, requiring the Fed to do even more, with even more damage. That’s not a risk I want to take.”

Policy Report

In a separate development, the Fed released a comprehensive report on Friday, highlighting that tighter credit conditions in the United States, following bank failures in March, may have an adverse effect on economic growth. The report also noted that additional policy tightening will be contingent upon incoming data.

According to the Fed’s semi-annual report to Congress, “The FOMC will determine meeting by meeting the extent of additional policy firming that may be appropriate to return inflation to 2% over time, based on the totality of incoming data and their implications for the outlook for economic activity and inflation.”

Fed Says Tighter Credit Conditions to Weigh on US Growth

The Fed’s report, which provides lawmakers with updates on economic and financial developments as well as monetary policy, was made available on the central bank’s website ahead of Chair Jerome Powell’s testimony before the House Financial Services Committee on June 21. Powell will subsequently appear before the Senate banking panel the following day.

The report further highlighted, “Evidence suggests that the recent banking-sector stress and related concerns about deposit outflows and funding costs contributed to tightening and expected tightening in lending standards and terms at some banks beyond what these banks would have reported absent the banking-sector stress.”