In a recent turn of events, oil prices experienced a significant decline due to mounting concerns surrounding the United States’ debt ceiling and speculation of an impending interest rate hike. This article explores the impact of these factors on the oil market and highlights the key players involved in navigating this challenging situation.

Hard-Right Republicans Express Concerns Over Debt Ceiling Deal

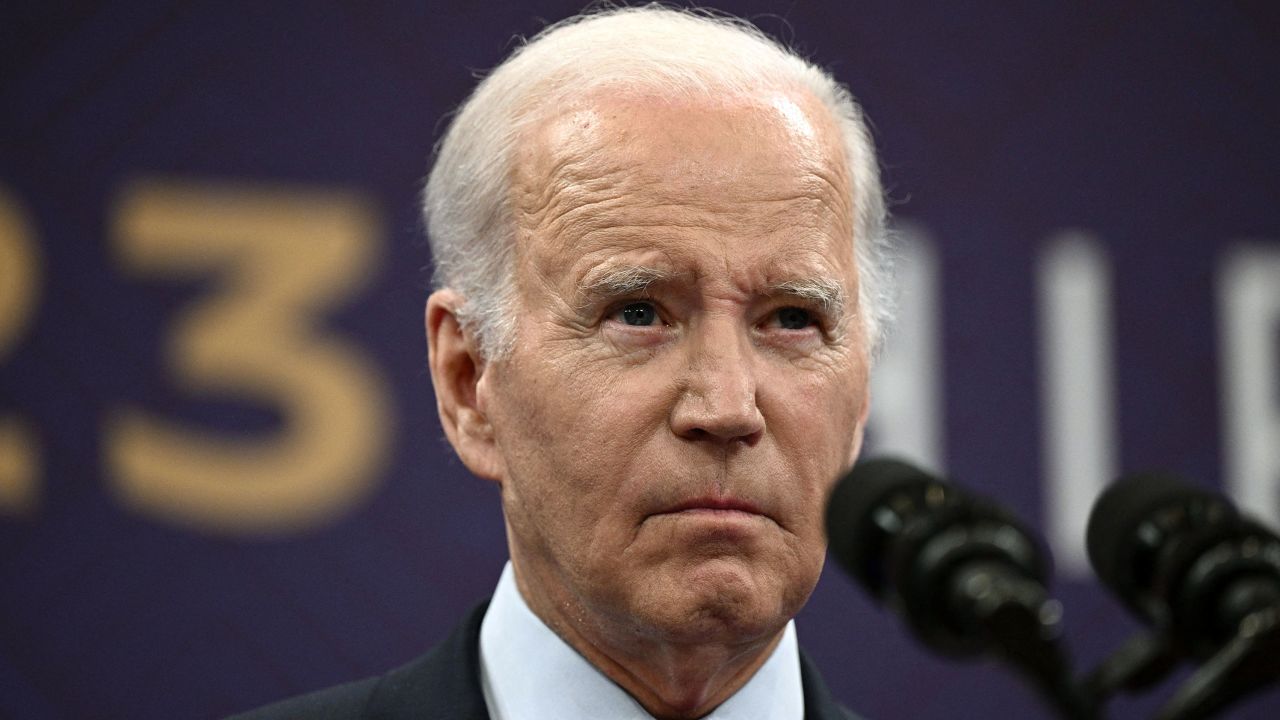

Some prominent hard–right Republican lawmakers have expressed their reservations about supporting a potential deal to raise the debt ceiling in the United States. As the world’s largest consumer of oil, such a decision holds considerable weight in the global market. Despite these concerns, both Democratic President Joe Biden and Republican House of Representatives Speaker Kevin McCarthy remain optimistic that the deal will ultimately come to fruition.

Debt Ceiling Deal’s Crucial Timeline and Implications

The agreement between President Biden and Speaker McCarthy needs to secure the approval of a divided U.S. Congress before June 5, which marks the date when the Treasury Department warns that the country may be unable to meet its financial obligations. Failure to reach a resolution by this deadline could potentially disrupt financial markets, adding further uncertainty to an already volatile situation.

Debt Ceiling Drama and its Effect on Oil Market

Amidst the ongoing debate surrounding the debt ceiling, the oil market finds itself on edge. Phil Flynn, an analyst at Price Futures Group, aptly describes the situation as the “big elephant in the room.” Until the necessary votes are secured in Congress, market sentiment is likely to remain apprehensive, potentially impacting oil prices.

Legislative Considerations and OPEC+ Meeting

The House of Representatives Rules Committee is scheduled to review a 99-page bill related to the debt ceiling at 3 p.m. (1900 GMT) on Tuesday. Following this, votes will take place in both the Republican-controlled House of Representatives and the Democratic-controlled Senate. It is worth noting that these legislative proceedings coincide with the June 4 meeting of OPEC+.

Uncertainty Surrounding OPEC+ Output Cuts

The looming debt deadline coincides with the highly anticipated OPEC+ meeting, where discussions about potential adjustments to oil output cuts are expected. While some uncertainties persist, Saudi Arabian Energy Minister Abdulaziz bin Salman issued a warning to short-sellers speculating on falling oil prices, hinting that OPEC+ might consider further output cuts. However, statements from Russian oil officials, including Deputy Prime Minister Alexander Novak, suggest that Russia favors maintaining the current production levels.

China’s Role and Fuel Demand Recovery

Beyond the intricacies of the debt ceiling and OPEC+ dynamics, market participants also closely monitor Chinese manufacturing and service sector data, set to be released later this week. The performance of these sectors provides crucial insights into the recovery of fuel demand in China, the world’s leading oil importer.

Conclusion

As oil prices experience a notable decline, influenced by the uncertainties surrounding the U.S. debt ceiling and speculations of a potential interest rate hike, the market eagerly awaits developments. The resolution of the debt ceiling debate, coupled with OPEC+’s decision on output cuts, and China’s fuel demand recovery will play significant roles in shaping the future trajectory of oil prices. Market participants remain vigilant as they navigate these complex factors in an ever-evolving landscape.