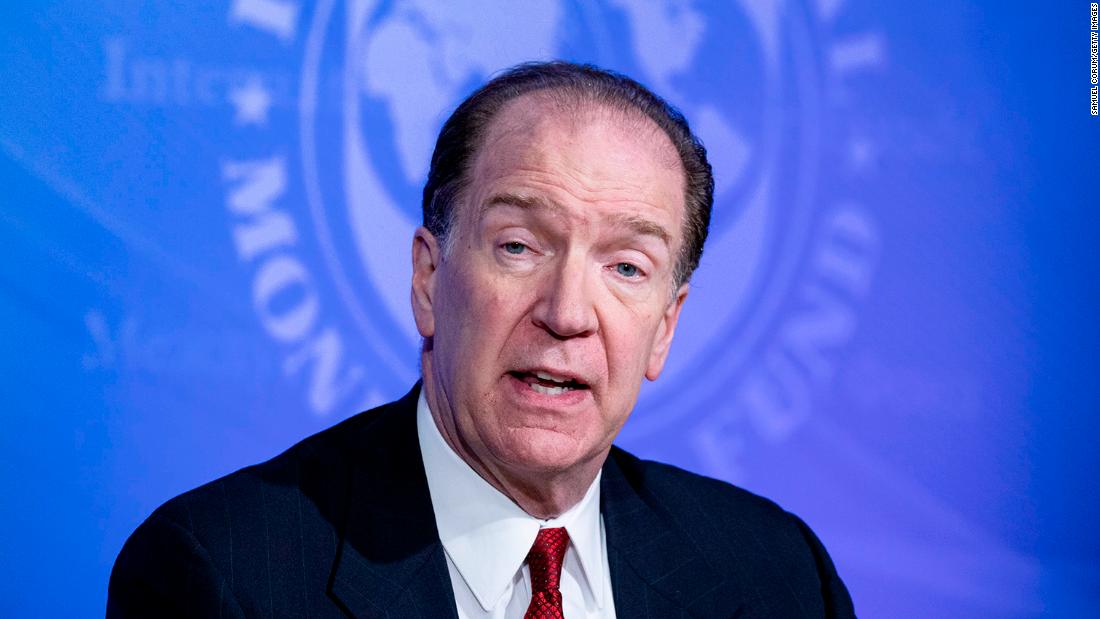

The intricate issue of a potential U.S. default is exacerbating the challenges that the sluggish global economy is already confronting. With escalating interest rates and elevated debt levels stifling the necessary investments to propel higher output, World Bank President David Malpass emphasized on Friday that this is a matter of great concern. During the meeting of the Group of Seven (G7) finance officials in Japan, they addressed the “very high importance” of raising the U.S. debt limit and avoiding the negative consequences of a prospective default on U.S. government debt for the first time ever.

In Malpass’s words, “Clearly, distress in the world’s biggest economy would be negative for everyone. The repercussions would be bad to not get it done.” On the sidelines of the G7 meeting, he spoke with Reuters and underscored the urgency of lifting the federal debt limit, as U.S. Treasury Secretary Janet Yellen had also reiterated on Friday. Failure by Congress to raise the $31.4 trillion debt limit would culminate in economic and financial catastrophe, as per Yellen’s warnings. She urged the Republican-controlled House of Representatives to agree to increase the debt limit, which is essential to prevent such a dire scenario.

During the G7 meetings, Malpass highlighted the need to boost productivity and growth while grappling with a high debt overhang that a growing number of countries are encountering. According to him, global growth is projected to drop below 2% in 2023 and could remain low for several years. One of the significant challenges is that advanced economies have accumulated so much debt that it would necessitate a substantial amount of capital to service it. As a result, developing countries would have too little investment, resulting in an extended period of sluggish growth. “That’s a big worry, and especially for people in poorer countries,” he added. “The world’s in a stressful spot, but I think the financial systems are holding up. The big question is growth, how do you get more growth and productivity.”

Malpass indicated that restructuring the debts of countries that had requested help was a pressing matter, and he welcomed the “some progress” made on Ghana. Reuters reported on Thursday that Ghana’s official creditors are poised to grant financing assurances and form a committee co-chaired by France and China, key steps for the nation to secure a $3 billion International Monetary Fund (IMF) loan. He expressed frustration at the slow pace of progress on the overall debt restructuring front, noting how difficult it was for countries to attract investment until they had agreements in place to make their debt more sustainable.

Malpass welcomed the progress made during the first two meetings of a new Global Sovereign Debt Roundtable that includes China, the world’s largest sovereign creditor, and private sector creditors. A third meeting was now planned in June, he said. “To actually get to these debt reductions is so important… for poor countries that have hit the wall in terms of unsustainable debt. It’s important to get it done as soon as possible.”

Regarding Suriname’s government and international bondholders’ new deal to restructure nearly $600 million in debt, Malpass expressed concern. Sources familiar with the deal say it includes a clause that would put a percentage of Suriname’s future oil revenues in an escrow account through 2050. In general, he worried about collateralized arrangements that often give the creditor a better hand. “So the details are still coming on Suriname and whether it turns out to be sustainable, but it’s really important for the countries to look carefully at what they’re giving up.”