The crypto market is currently witnessing a decline in Bitcoin bulls and a rise in bearish sentiment. The fear and greed index paints a clear picture of investors’ sentiment, which has fallen from a greed level of 65 in May to 48 at present.

The recent decline in the Bitcoin price rally to $30,000 this month can be attributed to various macro factors. Additionally, the speech delivered by US Fed Chair Jerome Powell on Friday failed to provide a definitive direction and insights into future rate hike possibilities. While there is hope among President Joe Biden and Republicans to avoid a debt ceiling crisis, it is important to acknowledge the existence of other lingering issues.

The CME FedWatch Tool indicates a probability of a 25 bps rate hike in June, coinciding with the rise of the DXY index and the tightness observed in the job market.

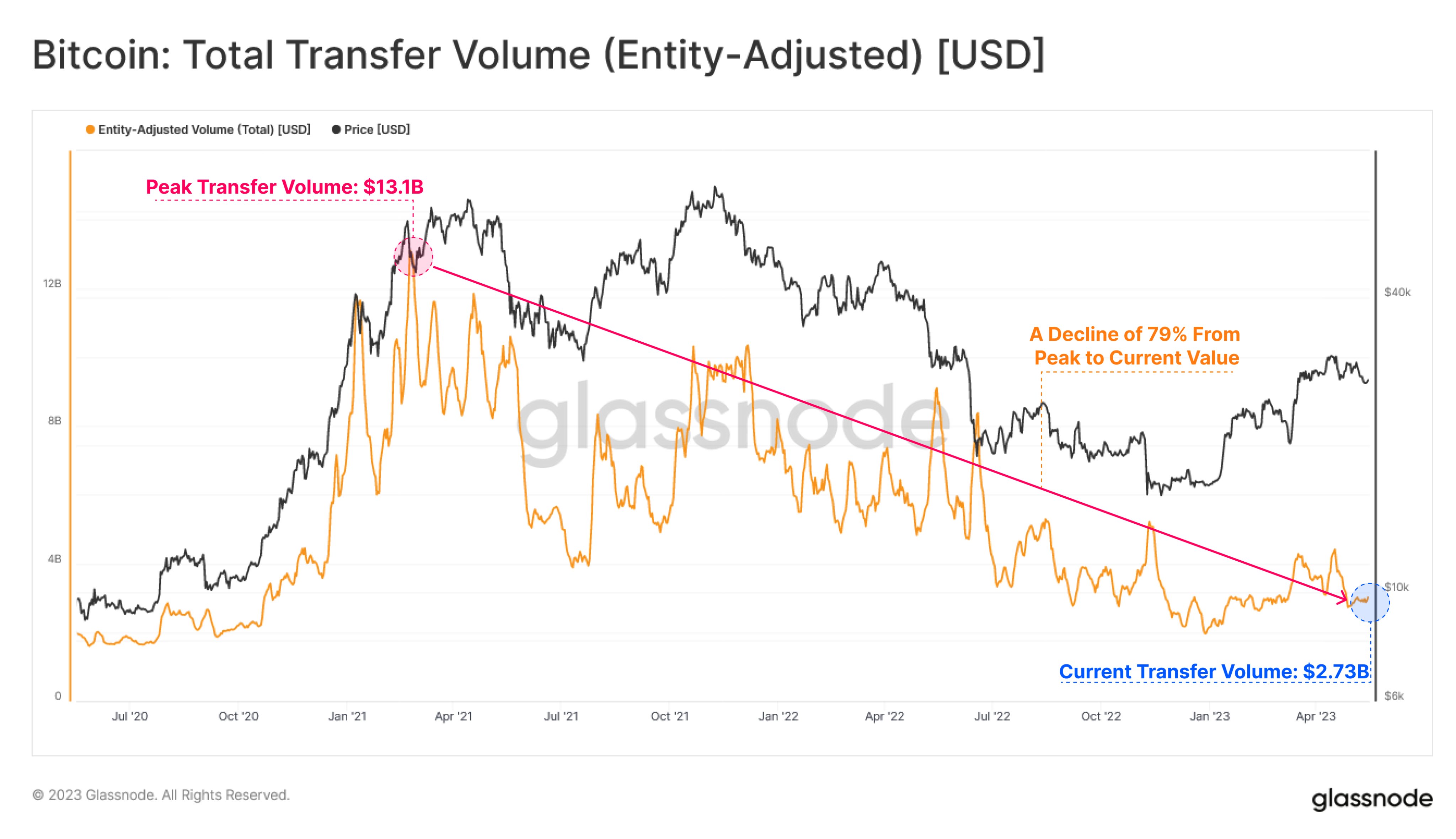

Despite a 75% recovery in Bitcoin price this year, the conditions for a bull market remain weak. Glassnode data reveals a decline in the total transfer volume on the Bitcoin network, currently standing at $2.73 billion per day. This marks a significant 79% decrease from its peak of $13.1 billion during the bullish market phase in 2021.

The pressing question now is whether the ongoing consolidation will lead to a new low, potentially suggesting lower prices. Experts predict a substantial drop below the 200-week moving average, targeting the crucial support level of $24,800.

So, will the Bitcoin price finally break out from this period of consolidation?

Prominent analysts such as CredibleCrypto and Michael van de Poppe suggest that the consolidation phase has most likely concluded and anticipate a positive upward movement in BTC price. However, it is essential to consider the weak chart pattern indicated by the 50-moving average and Bollinger bands. Bitcoin currently finds itself range-bound, with resistance at $27,640 and support at $26,340. A clear breakout beyond this range will determine the direction of the BTC trend.

It seems some have missed my major update from a few days ago and I talk about some important things to pay attention to in the coming weeks + my personal strategy and approach on $BTC vs alt holdings during this period. If you haven’t watched it yet, watch below👇 https://t.co/ZJi3BYAsdE

— CrediBULL Crypto (@CredibleCrypto) May 12, 2023

To summarize, the crypto market is experiencing a shift in sentiment with declining Bitcoin bulls and rising bearishness. Various macro factors and uncertainties, including the impact of US Fed policies, debt ceiling concerns, and the tightening job market, contribute to the current state. The decline in network activity and the possibility of a new low in Bitcoin price raise questions about the future trajectory. Nevertheless, analysts hold differing opinions, with some suggesting a potential breakout while others emphasize the weak chart patterns. Only time will reveal the true path for Bitcoin.