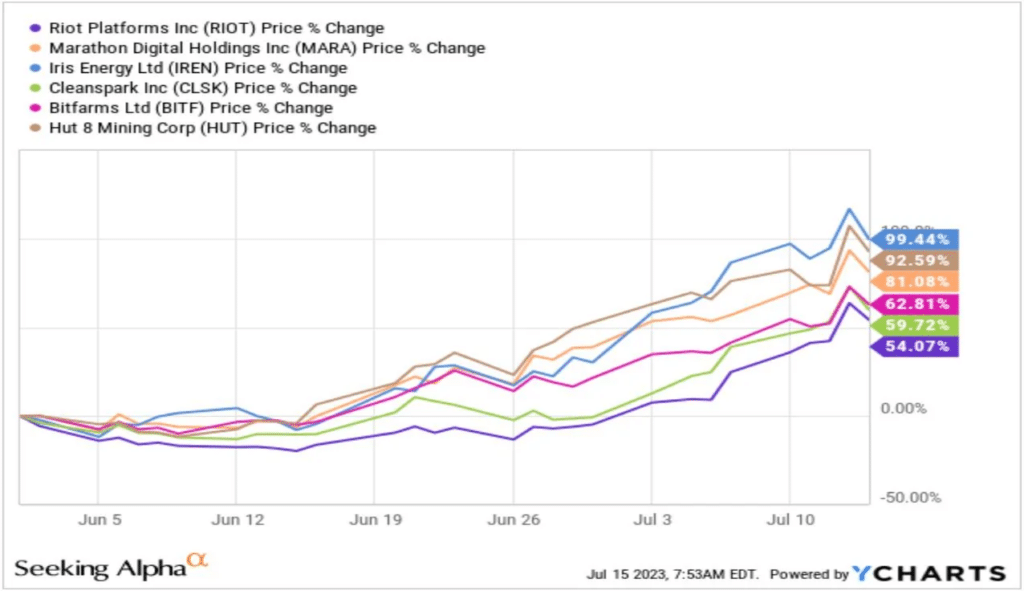

The year 2023 has been unique for Bitcoin mining stocks, showing superior performance compared to Bitcoin itself. Despite Bitcoin’s price volatility and remaining below $31,800 in late H1 2023, mining farm stocks like Riot and Marathon Digital have seen substantial growth, doubling their value in recent months.

Decoupling of Crypto Miner Stocks from BTC Prices

Traditionally, crypto mining stock prices follow the performance of Bitcoin in the secondary market. However, in 2023, this trend has been broken, leading to questions about the profitability of miners after the upcoming halving event.

The Impact of Halving on Miners’ Profits

The upcoming halving event, where miners’ rewards are halved, poses significant risks to Bitcoin mining. The reduction in block rewards will directly impact miners’ revenue. To remain profitable, BTC prices must surge above $100,000, according to a report shared on Reddit.

Challenges Faced by Mining Companies

Assuming prices remain at current levels, mining companies like Riot Platforms might need to issue new shares to raise funds for operational expenses. However, the issuance of new shares leads to dilution, resulting in a decrease in share prices.

Potential Decline in Hash Rate

Experts predict that the hash rate, which measures Bitcoin’s computing power, could fall by up to 30% after the halving event. The network’s supply economics may manage the halving, but miners will need to spend more input to confirm the same block, adding further pressure on top miners and farms.

Strategies for Sustainable Mining

To ensure long-term sustainability, mining farms must explore strategies to mitigate the risks posed by halving and market fluctuations. Some potential approaches include:

- Efficiency Upgrades: Mining farms should invest in cutting-edge hardware and optimize their operations to reduce energy consumption and increase mining efficiency.

- Diversification: Miners should consider diversifying their revenue streams by engaging in other blockchain-related activities or cryptocurrencies.

- Hedging Against Price Volatility: Utilize financial instruments like options and futures to hedge against price volatility, protecting profits in the face of price swings.

- Economies of Scale: Larger mining farms can benefit from economies of scale, reducing operational costs and maintaining profitability.

Conclusion

In conclusion, the future profitability of Bitcoin mining farms hinges on BTC prices surpassing $100,000 and being sustained at that level. The upcoming halving event poses significant challenges, but with strategic planning, efficiency improvements, and diversification, miners can navigate the changing landscape of the cryptocurrency market and ensure sustainable operations in 2024 and beyond.