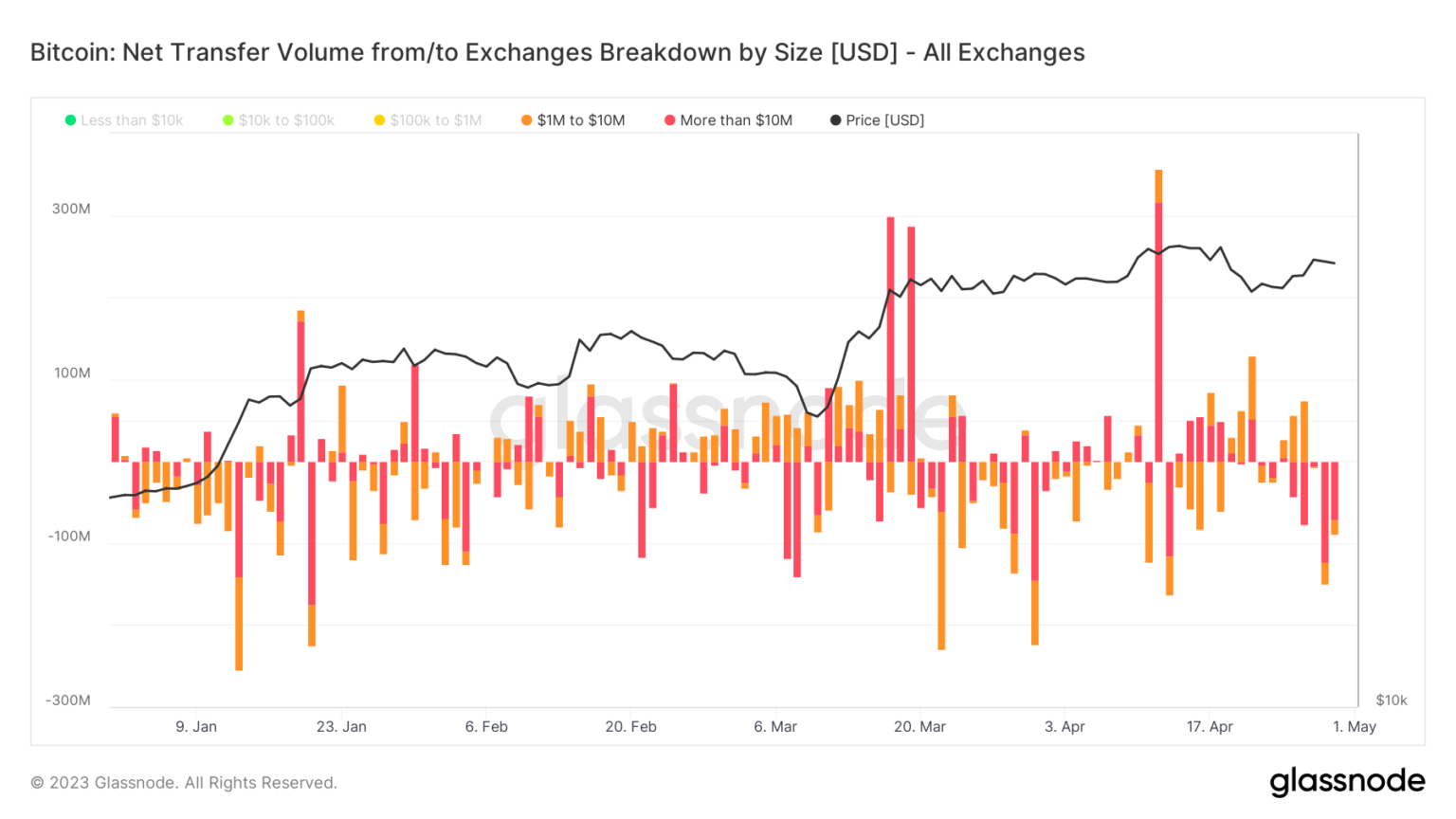

During the span of Friday and Saturday, an impressive sum of approximately $250 million in Bitcoin has been withdrawn from exchanges, indicating the fervent activity of these powerful market players.

This surge in aggressive buying coincides with the recent revelation that regulators are making a final, desperate endeavor to salvage First Republic Bank. This institution now joins the ranks of five other banks that have faced failure within the last fifty days, comprising a notable lineup including:

- Silicon Valley Bank.

- Silvergate Bank.

- Signature Bank.

- Credit Suisse.

Source glassnode

The intricate dance of Bitcoin whales, characterized by their relentless pursuit of accumulation, persists undeterred, unyielding even in the face of weekends. The staggering amount of $250 million worth of Bitcoin has been deftly extracted from exchanges during the timeframe spanning Friday and Saturday, showcasing the indomitable determination of these enigmatic creatures.

As if guided by an invisible force, these whales engage in an aggressive buying spree, their voracity matching the intensity of their acquisitions. This recent surge in purchasing activity coincides with the emergence of news regarding regulators’ last-ditch efforts to rescue First Republic Bank from its precarious situation. In a financial landscape marred by the failures of various institutions, this particular establishment becomes the latest addition to a growing list of casualties, a somber testament to the volatility and fragility of the banking sector.

First Republic Bank’s downfall serves as a poignant reminder of the turbulent times we find ourselves in, where once solid institutions now crumble under the weight of uncertainty. Joining its ill-fated counterparts, such as Silicon Valley Bank, Silvergate Bank, Signature Bank, and Credit Suisse, it paints a picture of a sector teetering on the precipice, its foundations shaken by waves of instability.

The whale-sized maneuvers within the Bitcoin ecosystem, marked by their relentless drive to accumulate, defy expectations even during the traditionally leisurely weekends. With unyielding force, these majestic creatures orchestrate the extraction of a staggering $250 million worth of Bitcoin from exchanges, leaving a trail of awe and intrigue in their wake.

Their relentless pursuit of acquisition coincides with the emergence of news that regulators, grasping at straws, are undertaking a final, desperate attempt to salvage First Republic Bank. As the fifth financial institution to stumble within a mere fifty-day span, this bank joins an unfortunate lineup of fallen giants, comprising the likes of Silicon Valley Bank, Silvergate Bank, Signature Bank, and Credit Suisse.

In the intricate tapestry of the crypto realm, where complexity intertwines with volatility, Bitcoin whales glide with purpose, their accumulation endeavors defying temporal constraints. Amid the tranquil ambiance of weekends, their robust presence disrupts the status quo as they deftly siphon off $250 million worth of Bitcoin from exchanges, leaving industry observers spellbound.

This remarkable surge in buying activity arrives on the heels of regulatory efforts to rescue First Republic Bank from its impending demise. Yet, this latest addition to the graveyard of financial institutions, joining the ranks of Silicon Valley Bank, Silvergate Bank, Signature Bank, and Credit Suisse, serves as a sobering reminder of the precarious nature of the banking landscape. In a world beset by turmoil, the haunting specter of failure looms large, casting shadows of uncertainty and leaving observers on edge.

With their immense presence and unwavering determination, Bitcoin whales continue to astound with their unrelenting pursuit of accumulation, displaying no signs of waning even amidst the tranquil embrace of weekends.